The 9-Minute Rule for Thomas Insurance Advisors

Wiki Article

4 Simple Techniques For Thomas Insurance Advisors

Table of ContentsThings about Thomas Insurance AdvisorsMore About Thomas Insurance AdvisorsLittle Known Questions About Thomas Insurance Advisors.The smart Trick of Thomas Insurance Advisors That Nobody is Talking About

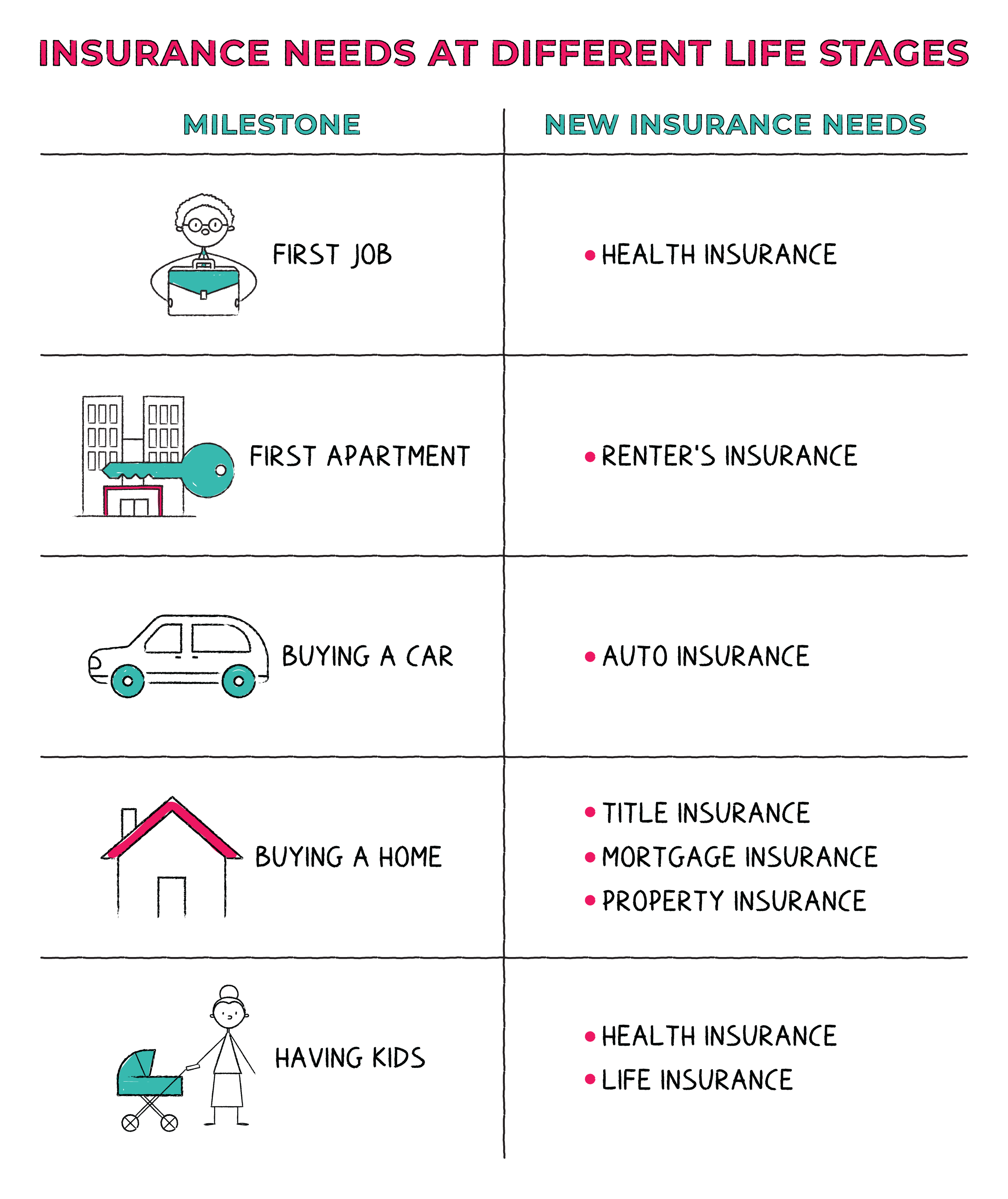

We can not prevent the unexpected from occurring, however sometimes we can safeguard ourselves as well as our households from the worst of the monetary results. Selecting the ideal kind as well as amount of insurance is based on your specific scenario, such as youngsters, age, way of living, and employment advantages - https://giphy.com/channel/jstinsurance1. Four kinds of insurance coverage that a lot of economists recommend consist of life, health, auto, and also long-lasting disability.Health insurance policy secures you from catastrophic bills in situation of a serious mishap or ailment. Vehicle insurance prevents you from bearing the monetary worry of a pricey crash.

It consists of a survivor benefit and likewise a cash value component - https://jstinsurance.onzeblog.com/21125865/thomas-insurance-advisors-your-trusted-insurance-partner-in-toccoa-ga. As the worth grows, you can access the money by taking a finance or withdrawing funds and you can end the policy by taking the cash money worth of the policy. Term life covers you for a set quantity of time like 10, 20, or thirty years as well as your premiums continue to be secure.

The 7-Minute Rule for Thomas Insurance Advisors

9% of married-couple households in 2022. They would certainly be likely to experience economic challenge as an outcome of one of their wage earners' deaths., or private insurance coverage you purchase for yourself and your family by getting in touch with health and wellness insurance firms directly or going through a health insurance policy representative.

If your earnings is low, you might be one of the 80 million Americans who are qualified for Medicaid.

According to the Social Protection Management, one in 4 workers going into the workforce will come to be disabled prior to they get to the age of retired life. Home Owners Insurance in Toccoa, GA. While health insurance coverage pays for a hospital stay and medical costs, you are frequently burdened with all of the expenditures that your paycheck had actually covered.

Getting The Thomas Insurance Advisors To Work

Numerous policies pay 40% to 70% of your revenue. The expense of special needs insurance coverage is based on numerous factors, consisting of age, way of living, and also health and wellness.Before you purchase, review the great print. Several plans require a three-month waiting period before the coverage kicks in, provide a maximum of three years' worth of protection, and also have considerable plan exclusions. Insurance in Toccoa, GA. Regardless of years of improvements in automobile safety, an estimated 31,785 individuals passed away in traffic crashes on U.S.

Mostly all states call for motorists to have vehicle insurance coverage as well as the few that don't still hold vehicle drivers economically in charge of any damages or injuries GA they trigger. Here are your options when acquiring car insurance: Responsibility insurance coverage: Pays for building damage and also injuries you trigger to others if you're at fault for a crash as well as additionally covers litigation expenses and also judgments or negotiations if you're taken legal action against as a result of a vehicle crash.

Comprehensive insurance policy covers burglary and damages to your auto because of floodings, hail, fire, criminal damage, falling items, as well as animal strikes. When you finance your auto or lease a vehicle, this kind of insurance policy is compulsory. Uninsured/underinsured motorist (UM) protection: If a without insurance or underinsured driver strikes your car, this insurance coverage pays for you as well as your guest's clinical expenditures and may additionally make up lost income or compensate for pain as well as suffering.

The smart Trick of Thomas Insurance Advisors That Nobody is Discussing

Clinical settlement insurance coverage: Medication, Pay protection assists pay for clinical expenditures, generally in between $1,000 as well as $5,000 for you as well as your passengers if you're injured in an accident. Similar to all insurance policy, your conditions will certainly establish the price. Contrast numerous price quotes as well as the protection given, and also examine periodically to see if you receive a lower price based upon your age, driving document, or the area where you live.Employer coverage is frequently the best alternative, however if that is not available, obtain quotes from numerous carriers as several give discount rates if you purchase greater than one kind of protection.

There are various insurance policies, and understanding which is appropriate for you can be tough. This guide will certainly talk about the different sorts of insurance policy as well as what they cover. We will likewise supply pointers on selecting the appropriate policy for your demands. Table Of Material Health and wellness insurance coverage is just one of the most important sorts of insurance coverage that you can have.

Depending on the policy, it can also cover oral and also vision treatment. When picking a wellness insurance coverage policy, you have to consider your specific requirements as well as the degree of insurance coverage you need. Life insurance policy is a policy that pays an amount to your beneficiaries when you die. It provides financial protection for your liked ones if you can not sustain them.

Report this wiki page